Application of Alternative Valuation Formulas for a Company Sale

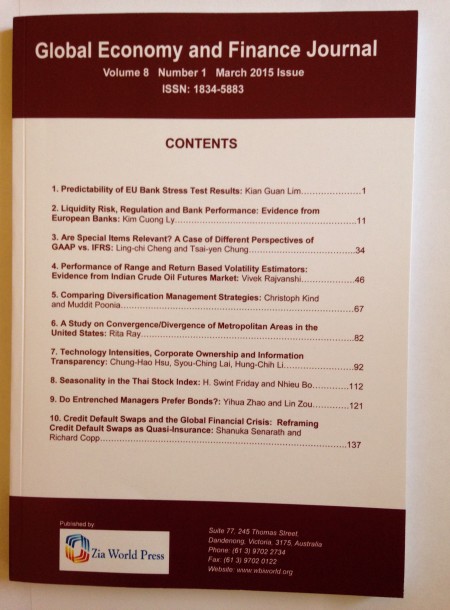

Global Economy and Finance Journal

Vol. 8. No. 2. , September 2015, Pages: 14 – 30Application of Alternative Valuation Formulas for a Company Sale

In this paper, a company owner (valuation subject) is interested in selling a company (valuation object). The potential seller must conduct a business valuation to determine what minimum price he must demand without the transaction proving disadvantageous. The purpose of our paper is to show how alternative valuation formulas solve this valuation problem under realistic imperfect market conditions. As a main conclusion, the business value can usually not be calculated using the future earnings method.JEL Codes: D46, G31 and G34