European Corporate Credit Returns: A Risk Return Analysis

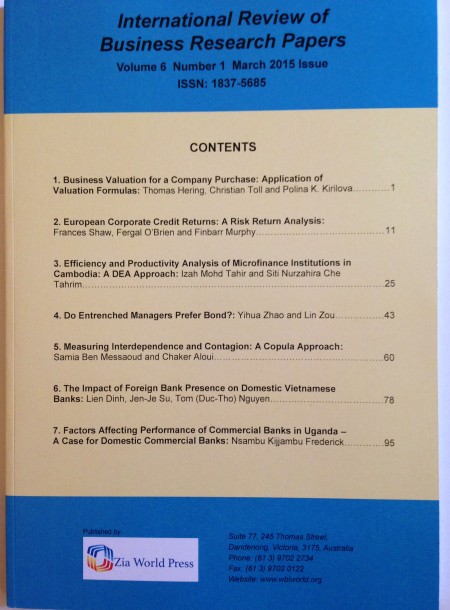

International Review of Business Research Papers

Vol. 11. No. 1. , March 2015, Pages: 11 – 24European Corporate Credit Returns: A Risk Return Analysis

Integration of European Capital markets has coincided with the development and exponential growth of credit derivative markets. As credit derivatives have matured as an asset class, we can regard them as return generating assets and not simply as risk transfer vehicles. The Capital Asset Pricing Model (CAPM) suggests that the return of holding such assets should be commensurate with their risk. This paper examines the risk-return characteristics of European Credit Default Swaps (CDSs). We empirically test the higher moment CAPM using European CDS returns collected from 2007 to 2010 on a broad range of investment grade corporate reference entities. Our findings show that both systematic risk and higher moment risks are significant in explaining European CDS returns. These are significant findings in an area of finance where there is currently a paucity of research.Field of Research: Systematic Risk, Credit Derivatives, Asset Pricing Models.