Performance of Range and Return Based Volatility Estimators: Evidence from Indian Crude Oil Futures Market

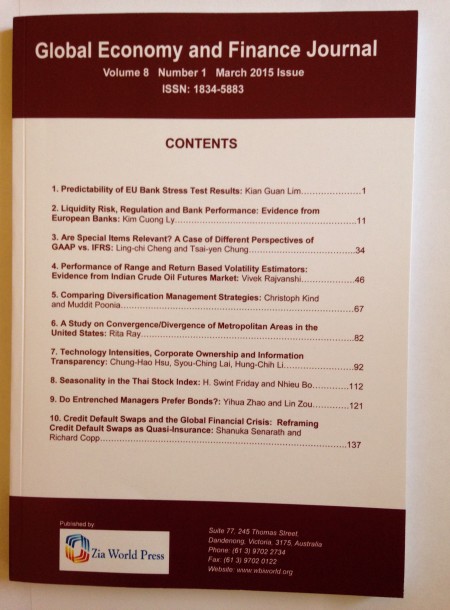

Global Economy and Finance Journal

Vol. 8. No. 1. , March 2015, Pages: 46 - 66Performance of Range and Return Based Volatility Estimators: Evidence from Indian Crude Oil Futures Market

This study compares the performance of various daily and intraday range based estimators for crude oil futures, which is one of the most liquid futures traded at Multi Commodity Exchange India Limited (MCX) for the period from July 2005 to July 2011. Findings show that the intraday realized range based estimator performed best as compared to the daily range based and classical estimator in terms of both efficiency and bias. Results of volatility estimation and forecasting performance show that realized range based estimators seems to be more economical and efficient to estimate the ‘true’ volatility.Key Words: High frequency, Commodity futures, two scales realized volatility, discreteness

JEL Classification:C13, C14